Executive Summary

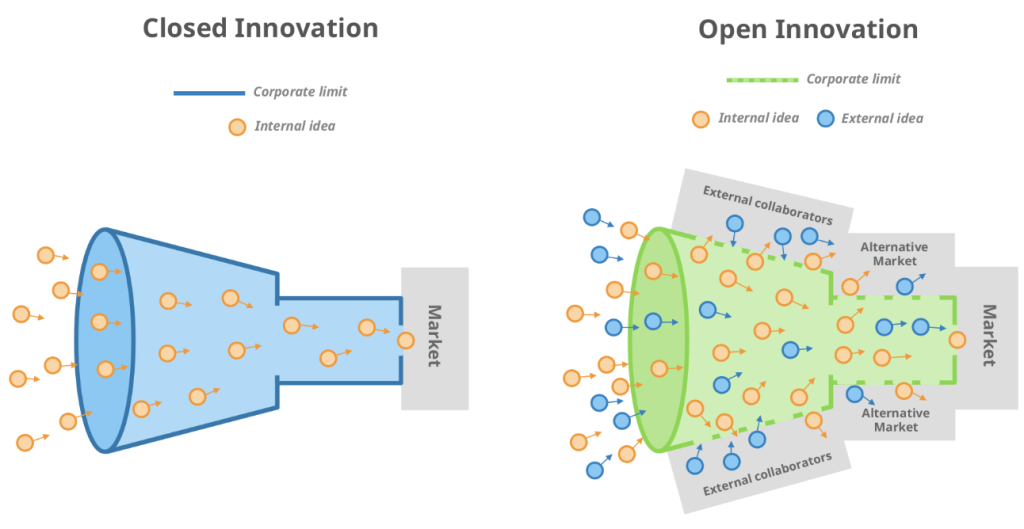

Open innovation is a powerful framework that bridges the gap between large corporations and startups to drive mutual growth. For Corporate Venture Capital (CVC) arms of large companies, investing in startups offers the opportunity to gain access to cutting-edge technologies, fresh ideas, and disruptive business models. On the other hand, startups can leverage CVC investments to scale, gain industry expertise, and expand their networks. The concept of open innovation fosters collaboration between established companies and emerging ventures, leading to the development of innovative products and services while providing lucrative financial opportunities for all parties involved. This article outlines how individuals and organizations can profit from open innovation, focusing on the investment strategies, market trends, and the steps needed to thrive in this growing space.

General Information

Market Trends

- Growing Focus on Collaboration: Traditional R&D models are being increasingly replaced by open innovation strategies, where external sources of knowledge, such as startups, universities, and independent researchers, are tapped to accelerate product development.

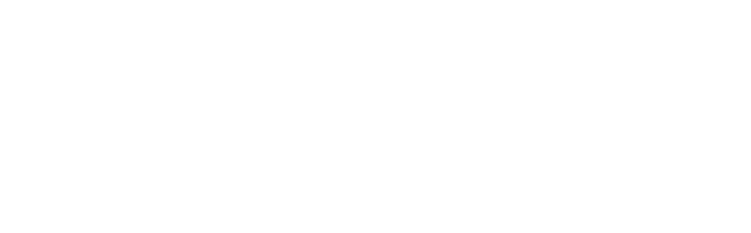

- Corporate Venture Capital Surge: In recent years, CVC investments have seen explosive growth. CVCs are now more actively engaging with startups, recognizing that innovation is a key driver of future competitiveness. From Silicon Valley to emerging markets, CVC arms are increasingly focused on diversifying their portfolios with disruptive technologies like AI, blockchain, and sustainability solutions.

- Rise of Innovation Hubs: Innovation ecosystems are emerging worldwide, where large corporations and startups co-exist, collaborate, and thrive. Regions like Silicon Valley, Tel Aviv, and Berlin have become magnets for venture capital and open innovation efforts. These hubs provide fertile ground for both corporate investors and entrepreneurs seeking investment.

- Focus on Strategic Synergies: Large companies are no longer just making financial investments but also seeking strategic synergies with startups. CVCs look to gain access to unique technologies or business models that can be integrated into their core operations, thus increasing their profitability and market relevance.

- Government and Institutional Support: Many governments and institutions are actively encouraging open innovation by providing grants, tax incentives, and accelerators to foster startup growth and innovation.

Stock Performance

Open innovation has a direct and indirect impact on stock performance. Companies actively engaged in open innovation through CVC investments have the potential for increased long-term returns due to early access to disruptive technologies. Notable trends in stock performances related to open innovation include:

- Tech Giants’ Performance: Companies like Google, Microsoft, and Intel have seen a positive impact on their stock prices from successful acquisitions and partnerships through open innovation channels. These companies often profit not only from financial returns on their investments but also from integrating new technologies into their operations.

- Startups in High-Growth Industries: Startups that secure investment through CVC funding often see a rapid increase in their valuation, with some, like Uber or Airbnb, achieving IPO success. These startups gain access to capital and resources from established players, enabling them to scale rapidly.

- Emerging Sectors: The market performance of stocks in sectors like AI, biotech, and fintech have been particularly strong. These sectors benefit from robust open innovation ecosystems where large companies and startups collaborate.

| Company | Ticker | Notable CVC Arm | YTD Stock Performance (2025) |

|---|---|---|---|

| Alphabet | GOOG | GV (Google Ventures), CapitalG | +20.3% |

| Microsoft | MSFT | M12 | +17.8% |

| Intel | INTC | Intel Capital | +12.4% |

| Qualcomm | QCOM | Qualcomm Ventures | +15.1% |

| Salesforce | CRM | Salesforce Ventures | +10.7% |

Business Model (Value Chain)

Inbound Logistics

Corporates identify and source external innovations through scouting, accelerators, VC partnerships, and university collaborations. Startups provide new technologies, ideas, and prototypes that feed the corporate innovation pipeline.

Operations

Startups and corporates co-develop products, run pilot projects, or integrate startup technologies into existing systems. This stage often involves R&D alignment, agile experimentation, and internal testing environments.

Outbound Logistics

Innovations are scaled and delivered to market using the corporate partner’s supply chains, distribution networks, and operational infrastructure — helping startups reach broader customer bases faster.

Marketing and Sales

Corporates leverage their brand, sales force, and customer relationships to market the startup’s innovation. Joint marketing campaigns or bundled offerings often help increase visibility and trust.

Service

Post-launch, corporations offer ongoing support such as infrastructure (e.g. cloud, logistics), technical assistance, or customer service. This ensures the product can scale sustainably and adapt to market feedback.

Business Environment (Supply Chain)

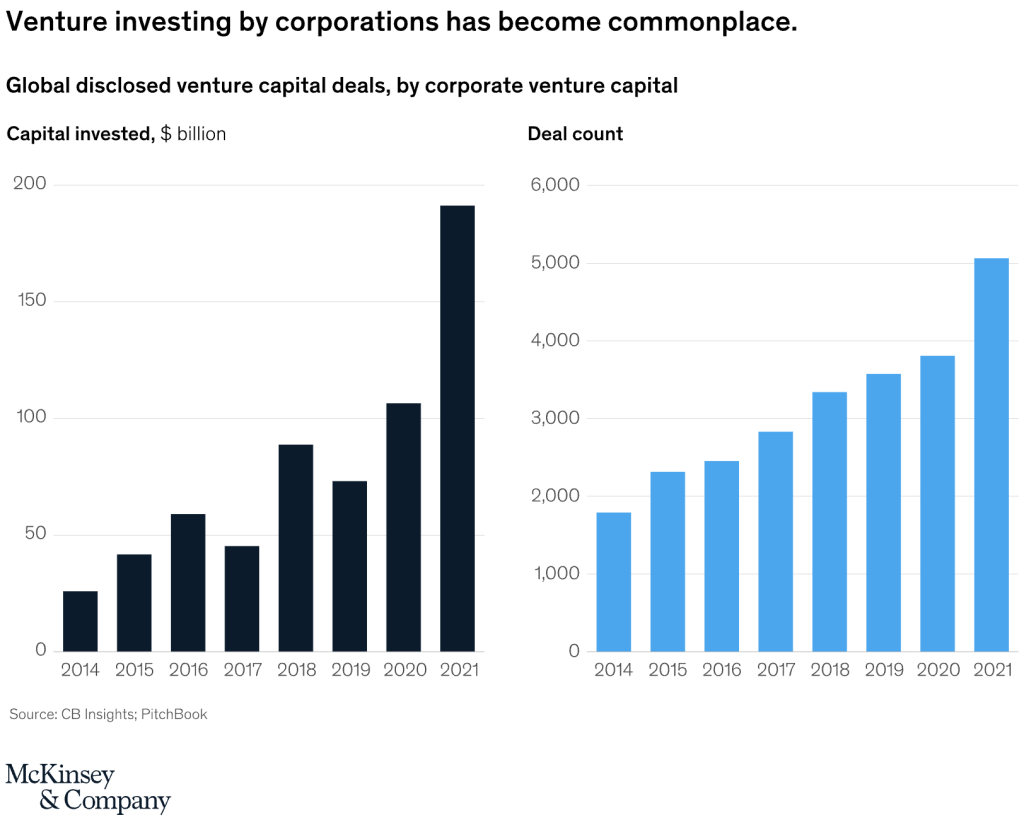

Capital Supply: CVC arms and venture capitalists provide the necessary funding to startups, enabling them to build prototypes, conduct research, and bring products to market.

Knowledge Supply: Startups provide cutting-edge technologies, disruptive business models, and novel solutions. Corporations, in return, offer their industry expertise, market insights, and operational know-how.

Technology Transfer: Startups can benefit from leveraging the existing technologies and infrastructure of larger corporations, speeding up development and reducing costs.

Market Access: Established corporations provide startups with the necessary access to global markets and distribution networks, which can significantly enhance the scalability of a startup’s products or services.

Introducing Steps

To successfully navigate the open innovation landscape, both startups and corporations can follow these steps:

- Identify Strategic Objectives: Startups should identify the technologies or business models they wish to scale. Corporations should determine the innovation areas they want to explore and areas where external collaborations are needed.

- Engage with Innovation Hubs: Both corporations and startups should become active in innovation hubs, industry events, and startup competitions to network and find potential collaborators.

- Create a Collaboration Framework: Establish a mutually beneficial collaboration framework that outlines the terms of investment, roles, expectations, and exit strategies.

- Explore Funding Options: Startups should explore various funding sources, such as CVC, accelerators, or angel investors, while corporations should formalize their CVC strategies to find and invest in promising startups.

Advanced Information

Advanced Steps

As companies and startups move forward with their open innovation strategies, the following advanced steps should be taken:

- Leverage Mergers and Acquisitions: When a startup reaches a critical scale, corporations can look into M&A opportunities to further solidify their position in the market.

- Foster Long-Term Relationships: Ongoing partnerships can result in sustained innovation. Corporations can work closely with startups on joint ventures, R&D collaborations, or product co-development initiatives.

- Optimize Innovation Portfolios: CVC arms should regularly reassess their portfolios to ensure they are investing in the most strategically aligned and high-potential startups.

SASAL Can Support You

Insourcing

If you’re ready to make Open Innovation a core capability within your organization, SASAL is here to guide you every step of the way. With our CSO Sharing Service, you’ll receive expert, personalized support to properly insource Open Innovation and to drive growth.

Outsourcing

If you’re looking to leverage open innovation but lack the resources or expertise, SASAL can handle the entire process for you. From identifying promising startups to managing investments and integrating new technologies, we take care of everything, so you can focus on growth and enjoy the results.

Practice

| Build Strong Startup Partnerships | Early-stage investment | Network through startup accelerators, corporate pitch events, and innovation hubs. Use corporate resources to scout for disruptive technologies. |

| Maximize Financial Returns | Strategic funding & exit strategies | Monitor startup progress, identify synergies, and set clear exit strategies, such as IPOs or acquisitions. |

| Foster Ongoing Collaboration | Long-term engagement | Create co-development agreements, joint ventures, and maintain communication with startups to encourage continuous growth and alignment. |

| Expand Market Reach | Access to distribution networks | Leverage corporate partners’ existing infrastructure to enhance product visibility and distribution channels. |

| Promote Innovation Ecosystems | Ecosystem development | Invest in innovation hubs, accelerators, and foster a culture of collaboration across industries to drive long-term innovation and mutual benefits. |