In this article, SASAL would like to share the importance of global trade. Tariffs are a powerful tool in international trade policy, used to protect domestic industries, generate revenue, and influence trade relationships. However, they can also lead to higher consumer prices and trade disputes. Understanding how tariffs work helps in comprehending the complexities of global trade dynamics.

United States

The United States remains a pivotal player in global trade, characterized by its substantial import and export activities. Here are some detailed trends:

- Reshoring Manufacturing: In recent years, there has been a significant push to bring manufacturing back to the U.S. This initiative aims to reduce dependency on foreign supplies, particularly in critical sectors such as technology and pharmaceuticals. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting this shift.

- Trade Deficit: The U.S. often runs a trade deficit, meaning it imports more than it exports. This is particularly evident in consumer goods and electronics. Efforts to balance this deficit include negotiating new trade deals and imposing tariffs on certain imports.

- Technological Exports: Despite the trade deficit, the U.S. is a leading exporter of advanced technology products, including aerospace, medical devices, and software.

China

China continues to dominate global trade with its vast export of manufactured goods. Detailed trends include:

- High-Tech Imports: To support its manufacturing sector, China has been increasing its imports of high-tech products and raw materials. This includes semiconductors, which are crucial for electronics manufacturing.

- Belt and Road Initiative: This ambitious infrastructure project aims to expand trade routes and partnerships across Asia, Africa, and Europe. By investing in infrastructure in these regions, China is creating new markets for its goods and securing supply chains.

- Export Dominance: China remains the world’s largest exporter, with significant exports in electronics, machinery, and textiles. The country’s trade policies and competitive pricing have solidified its position in global markets.

Germany

Germany’s economy is heavily reliant on exports, particularly in the automotive and machinery sectors. Here are some detailed insights:

- Export Reliance: A significant portion of Germany’s GDP comes from exports. This makes the country highly sensitive to global economic shifts and trade policies. For instance, trade tensions between major economies can have a direct impact on German exports.

- Trade Surplus: Germany often runs a trade surplus, meaning it exports more than it imports. This surplus is driven by high demand for German engineering and manufacturing, particularly in the automotive sector.

- Green Technology: Germany is also a leader in green technology exports, including renewable energy solutions and energy-efficient machinery. This aligns with global trends towards sustainability and environmental responsibility.

India

India is expanding its trade footprint by diversifying its export base. Detailed trends include:

- Pharmaceuticals and Electronics: India is becoming a major exporter of pharmaceuticals and electronics. The country’s pharmaceutical industry is known for producing generic drugs at competitive prices, while its electronics sector is growing rapidly.

- Trade Agreements: India is actively seeking new trade agreements to boost exports and reduce trade barriers. These agreements aim to open up new markets for Indian goods and services, enhancing the country’s global trade presence.

- Service Exports: In addition to goods, India is a leading exporter of IT services. The country’s IT sector provides software development, customer support, and other services to clients around the world.

Japan

Japan’s trade is characterized by high-tech exports and a significant trade surplus. Detailed trends include:

- Technological Exports: Japan is known for its advanced technology products, including automobiles, electronics, and robotics. These high-value exports contribute significantly to the country’s trade surplus.

- Supply Chain Challenges: Japan faces challenges from regional competition and shifting global supply chains. The country is adapting by investing in new technologies and seeking to diversify its supply sources.

- Aging Population: Japan’s aging population presents both challenges and opportunities for trade. While it may reduce the domestic labor force, it also drives demand for advanced healthcare technologies and services.

Developing Countries

Many developing countries are working to increase their participation in global trade. Detailed trends include:

- Infrastructure Improvements: Investing in infrastructure is a key strategy for many developing countries. Improved ports, roads, and communication networks facilitate trade and attract foreign investment.

- Reducing Barriers: Efforts to lower trade barriers, such as tariffs and quotas, are helping developing countries integrate more fully into the global economy. These measures make it easier for these countries to export their goods and services.

- Diversification: Developing countries are diversifying their economies to reduce reliance on a single export commodity. This includes expanding into new sectors such as manufacturing, services, and technology.

What Are Tariffs?

Tariffs are taxes or duties imposed by a government on imported goods. They are designed to make imported products more expensive compared to domestic products, thereby protecting local industries from foreign competition1.

- Ad Valorem Tariffs: These are calculated as a percentage of the value of the imported goods. For example, a 10% ad valorem tariff on a $100 item would add $10 to its cost2.

- Specific Tariffs: These are fixed fees based on the quantity of goods imported, such as $5 per kilogram2.

- Compound Tariffs: These combine both ad valorem and specific tariffs, applying a percentage of the value plus a fixed fee2.

How Tariffs Work

- Imposition: When a country imposes a tariff, it increases the cost of imported goods. This makes foreign products less competitive compared to domestic products2.

- Collection: Tariffs are collected by the customs authority of the importing country. For example, in the U.S., the Customs and Border Protection agency collects tariffs on behalf of the Commerce Department2.

- Impact on Prices: The additional cost of tariffs is usually passed on to consumers, leading to higher prices for imported goods2.

Reasons for Tariffs

- Protecting Domestic Industries: Tariffs protect emerging or struggling domestic industries from foreign competition by making imported goods more expensive2.

- Revenue Generation: Governments use tariffs as a source of revenue2.

- Retaliation: Tariffs can be used as a tool for retaliation in trade disputes. If one country imposes tariffs, the affected country might respond with its own tariffs3.

- National Security: Tariffs can protect industries crucial to national security, such as defense and technology2.

Effects of Tariffs

- Trade Flows: Tariffs can alter global trade flows by making certain goods more expensive and less attractive to import3.

- Economic Impact: While tariffs can protect domestic jobs and industries, they can also lead to higher prices for consumers and potential trade wars3.

- Retaliation: Countries affected by tariffs often impose retaliatory tariffs, which can escalate into trade disputes and reduce overall trade3.

Examples of Tariffs in Action

- U.S.-China Trade War: The U.S. imposed tariffs on Chinese goods to address trade imbalances and intellectual property theft. China responded with its own tariffs on U.S. goods, leading to a significant reduction in trade between the two countries3.

- EU Tariffs on Steel: The European Union has imposed tariffs on steel imports to protect its steel industry from cheaper foreign steel, particularly from China2.

1: MasterClass 2: Investopedia 3: The Hartford

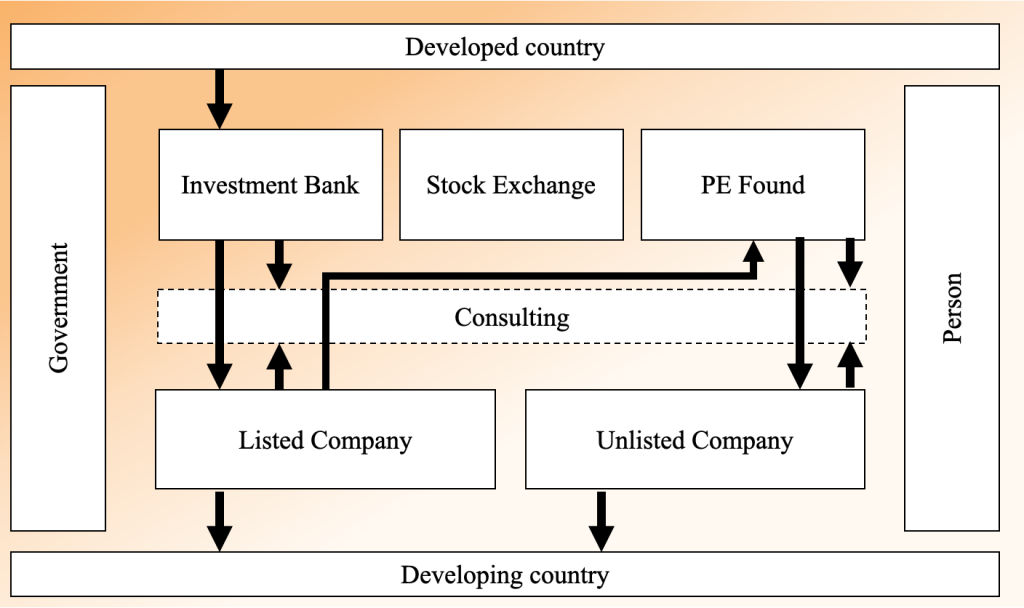

SASAL, INC is able to support global trade for both sides, including supplier buyers. Please join the SASAL Counselor first.