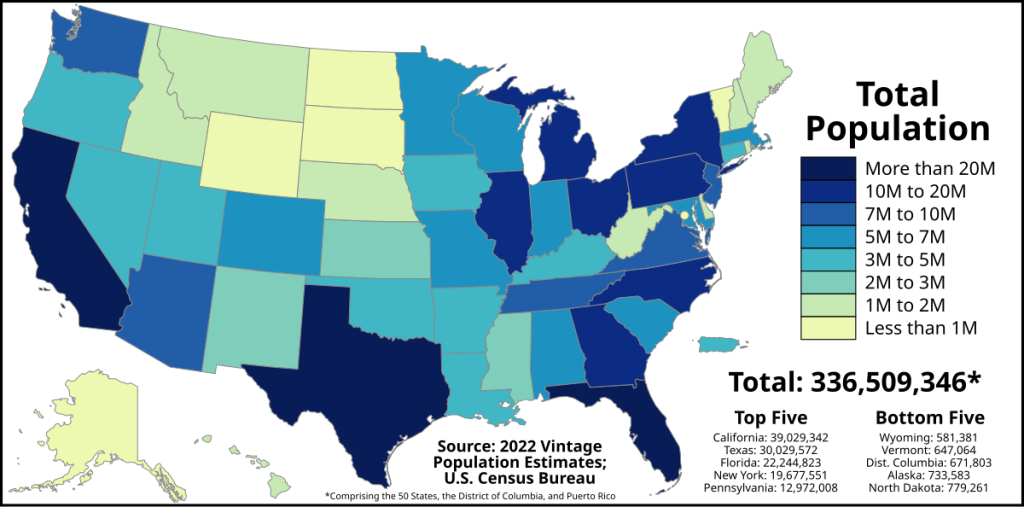

In the US

Here are some top companies in the US that are popular among job-hunting students:

- Google: Known for its innovative culture and excellent internship programs, Google offers numerous opportunities for students in various fields, including technology, marketing, and business.

- Amazon: With its vast range of services and products, Amazon provides many opportunities for students in technology, business, and logistics.

- Microsoft: A leader in technology and software development, Microsoft offers a variety of internships and entry-level positions for students.

- Goldman Sachs: A leading global investment banking firm, Goldman Sachs is highly sought after by students interested in finance and economics.

- Facebook (Meta): With its dynamic work environment and focus on cutting-edge technology, Facebook is a popular choice for students pursuing careers in tech and social media.

- J.P. Morgan: Another top financial institution, J.P. Morgan offers extensive internship and entry-level programs for students interested in banking and finance.

- IBM: Known for its contributions to technology and innovation, IBM provides a range of opportunities for students in engineering, computer science, and business.

- Deloitte: As one of the “Big Four” accounting firms, Deloitte is a top choice for students interested in accounting, consulting, and business services.

- PwC (PricewaterhouseCoopers): Another “Big Four” firm, PwC offers various programs for students in accounting, finance, and consulting.

- Bloomberg: Known for its financial software, data, and media services, Bloomberg is a great place for students interested in finance, technology, and journalism.

These companies are known for their robust internship programs, entry-level positions, and career development opportunities, making them attractive to students starting their careers[1][2].

References

[1] Top 100 companies hiring students on Handshake right now

[2] Forbes 2024 America’s Best Employers For New Grads – Ranked List

In New York

New York City is a hub for ambitious students seeking job opportunities. Here are some top companies and organizations that are popular among job-hunting students:

- Google: Known for its innovative culture and excellent internship programs, Google offers numerous opportunities for students in various fields, including technology, marketing, and business.

- Goldman Sachs: A leading global investment banking firm, Goldman Sachs is highly sought after by students interested in finance and economics.

- Facebook (Meta): With its dynamic work environment and focus on cutting-edge technology, Facebook is a popular choice for students pursuing careers in tech and social media.

- J.P. Morgan: Another top financial institution, J.P. Morgan offers extensive internship and entry-level programs for students interested in banking and finance.

- IBM: Known for its contributions to technology and innovation, IBM provides a range of opportunities for students in engineering, computer science, and business.

- Deloitte: As one of the “Big Four” accounting firms, Deloitte is a top choice for students interested in accounting, consulting, and business services.

- PwC (PricewaterhouseCoopers): Another “Big Four” firm, PwC offers various programs for students in accounting, finance, and consulting.

- Morgan Stanley: This financial services firm is popular among students looking for careers in investment banking and financial management.

- Bloomberg: Known for its financial software, data, and media services, Bloomberg is a great place for students interested in finance, technology, and journalism.

- Amazon: With its vast range of services and products, Amazon offers numerous opportunities for students in technology, business, and logistics.

These companies are known for their robust internship programs, entry-level positions, and career development opportunities, making them attractive to students starting their careers[1][2].

References

[1] 19 Top NYC Staffing Agencies and Recruiting Firms – Built In

[2] 5 top College Recruiting companies and startups in New York City … – F6S

For Harvard

Harvard students are highly sought after by many top companies across various industries. Here are some of the most popular companies among Harvard job-hunting students:

- McKinsey & Company: Known for its prestigious consulting roles, McKinsey is a top choice for Harvard graduates interested in management consulting.

- Goldman Sachs: This leading global investment banking firm is highly attractive to students pursuing careers in finance and economics.

- Google: With its innovative culture and excellent opportunities in technology, Google is a favorite among Harvard students.

- Amazon: Offering a wide range of roles in technology, business, and logistics, Amazon is a popular destination for Harvard graduates.

- Facebook (Meta): Known for its dynamic work environment and focus on cutting-edge technology, Facebook attracts many Harvard students.

- Apple: With its emphasis on innovation and design, Apple is a top choice for students interested in technology and product development.

- J.P. Morgan: Another leading financial institution, J.P. Morgan offers extensive banking and finance opportunities.

- Bain & Company: This consulting firm is well-regarded for its work culture and career development opportunities, making it a popular choice for Harvard graduates.

- Microsoft: A leader in technology and software development, Microsoft provides numerous opportunities for students in various fields.

- Deloitte: As one of the “Big Four” accounting firms, Deloitte is a top choice for students interested in accounting, consulting, and business services[1][2].

These companies are known for their robust internship programs, entry-level positions, and career development opportunities, making them attractive to Harvard students starting their careers.

References

[1] Harvard University Placements 2024: Highest Packages, Top Companies

[2] Harvard University Placements: Professions, Industry, Salary, and …